The Antitrust Economics of Multi-Sided Platform Markets

Multi-sided platforms coordinate the demands of distinct groups of customers who need each other in some way. Dating clubs, for example, enable men and women to meet each other; magazines provide a way for advertisers to find an audience; and computer operating system vendors provide software that applications users and applications developers can use together. When devising pricing and investment strategies, multi-sided platforms must account for interactions among the demands of multiple groups of customers. In theory, the optimal price to customers on one side of the platform is not based on a markup formula such as the Lerner condition, and price does not track marginal cost. Indeed, many actual platform businesses charge one side little or nothing--shopping malls seldom charge shoppers; operating system vendors give developers many services for free; most Internet portals and free television providers do not charge viewers. Competition among platforms takes place in multi-sided markets in which seemingly distinct customer groups are connected through interdependent demand and a platform that, acting as an intermediary, internalizes the resulting indirect network externalities. Multi-sided platforms arise in many economically significant industries from media to payment systems and software; they arise in bricks and mortar industries such as shopping malls as well as information-based industries such as portals.

The economics of platform competition has implications for analyzing antitrust and regulatory policies affecting businesses that compete in multi-sided markets. For example, market definition and market power analyses that focus on a single side will lead to analytical errors; since pricing and production decisions are based on coordinating demand among interdependent customer groups, one must consider the multiple market sides in analyzing competitive effects and strategies. To take another example, efficient pricing may result in setting price on a particular market side below measures of average variable or marginal cost incurred for customers on that market side. Economic analysis that ignores the multi-sided nature of the market might conclude erroneously that below-cost prices are predatory. Line-of-business restrictions in regulation as well as theories of market leveraging in antitrust are other areas that are illuminated by the economics of multi-sided platform markets. Line-of-business restrictions may hinder the emergence of a platform and deprive consumers of its benefits. Efforts to coordinate interdependent markets--and thereby produce potential efficiency gains in multi-sided markets--must be distinguished from efforts to extend a monopoly from one product to another. Businesses may devise anticompetitive strategies in multi-sided platform markets just as in single-sided markets. Multi-sided strategies for doing so, though, are likely to be more complex and less transparent than those used in single-sided markets. There is, however, no basis for asking regulators or antitrust enforcers to steer clear of these industries or to spend extra effort on them. An understanding of the unique economic principles that govern pricing and investment in multi-sided markets will lead to discerning and efficient regulation of this important type of business.

Introduction

I. Economics of Multi-Sided Platform Markets

A. Necessary Conditions for the Emergence of a Platform Business

B. Types of Multi-Sided Platform Businesses

C. Multi-Sided Versus Single-Sided Markets

D. Profit-Maximizing Pricing by Multi-Sided Platform Businesses

- Pricing by a Multi-Sided Platform Facing Multiplicative Demand

- The Pricing Structure and Indirect Network Externalities

- The Relationship Between Prices and Costs

- Pricing with Platform Competition

- Complexity and Dynamics

E. Pricing Structures and Strategies

F. Multi-Sided Markets and Social Welfare

II. Antitrust Analysis of Multi-Sided Platform Markets

A. Market Definition and the Evaluation of Market Power

- Market Definition

- Market Power

- Barriers to Entry

B. Predatory Strategies Under the Rule of Reason

- Predatory Pricing

- Market Foreclosure Strategies

C. Countervailing Efficiencies

- Cooperation Among Competitors

- Efficiencies from Internalizing Network Externalities

Conclusion

Introduction

Dating clubs--typically bars or cafes--are an innovative way for men and women to meet each other in Japan.

1 At one club, for example, men and women sit on opposite sides of a glass divide. If a man sees a woman he likes, he can ask a waiter to carry a "love note" to her.

2 Dating clubs sell patrons the prospect of making a match.

3 Their business works only if they attract enough members of the opposite sex to their club to make a match likely. Enough men must participate to attract women, and enough women to attract men. The club must figure out how much to charge men and women to get the right number and mix of patrons, while at the same time make money. One bar does this by charging men $100 for membership plus $20 a visit, and letting female members in free of charge.

4 An unscientific survey shows that a pricing structure that obtains a disproportionate share of the revenues from men is common in singles bars, discotheques, and other businesses around the world that help men and women find companionship.

5

Matchmaking is an example of a product that must be used by two or more groups of customers to be valuable to any single customer. Businesses that sell these products need customers of type A to get customers of type B and vice versa. To get both sides on board, businesses operate a "platform" that connects or coordinates the activities of multiple groups of customers. The dating club, for example, aggregates men and women and provides a place for them to meet and transact a date. Many economically significant industries are based on platform businesses that serve multiple disparate communities. Examples include shopping malls (retailers and shoppers), video game consoles (game developers and users), debit cards (cardholders and merchants), operating system software (applications developers, hardware manufacturers, and users), media (advertisers and viewers), and exchanges (buyers and sellers).

Platform businesses compete in "multi-sided markets." For example, video game console companies such as Sony, Nintendo, and Microsoft compete for game developers and users, while payment card companies such as American Express, MasterCard, and Visa compete for merchants and cardholders. Platform businesses must deal with interdependent demand when devising pricing, production, and investment strategies. These strategies can be quite different from non-platform businesses that do not serve mutually dependent customer groups. The optimal price on a particular side of the market, whether measured socially or privately, does not follow marginal cost on that side of the market. Many platform businesses charge one side little or nothing; for example, most operating system vendors collect scant revenue from software developers who use their intellectual property. In many cases, the joint provision of a good that services multiple groups of customers makes the assignment of costs to any one side arbitrary; for example, there is no economically meaningful allocation of the costs of developing or manufacturing video game consoles to individual game developers or users.

The economics of platform competition has implications for antitrust and regulatory policies in multi-sided markets. Predatory pricing is an obvious example. Efficient pricing may result in setting price on a particular market side below measures of average variable or marginal cost incurred for customers on that market side. Economic analysis that ignores the multi-sided nature of the market might conclude erroneously that this is an example of simultaneous recoupment--low prices on one side are being used to obtain or maintain market power on another side.

Market definition and market power analyses are another example. These analyses typically focus on the effect of a price change on demand in a narrowly defined market. For firms that compete in multi-sided markets, a price change on one side of the market has positive feedback effects on the other sides of the market; the analyst must consider these crossover effects to determine the overall effect of a price change on profits.

Line-of-business restrictions in regulation as well as theories of market leveraging in antitrust are other areas that the economics of multi-sided platform markets illuminates. Line-of-business restrictions may hinder the emergence of a platform and deprive consumers of its benefits. Efforts to coordinate interdependent markets--and thereby produce potential efficiency gains in multi-sided markets--need to be distinguished from efforts to extend a monopoly from one product to another. Businesses may devise anti-competitive strategies in multi-sided platform markets just as they may do in single-sided markets. Multi-sided strategies for doing so are likely to be more complex and less transparent than those used in single-sided markets. The fact that pro-competitive practices will be no less complex makes antitrust analysis difficult.

U.S. and foreign antitrust enforcement agencies have scrutinized multi-sided platform businesses in several significant antitrust matters. These include the AOL-Time Warner merger (U.S. and European authorities investigated two-sided markets such as Internet portals, magazines, and free television);

6 the credit card association investigations (Australian and European authorities investigated a two-sided market involving merchants and card users);

7 U.S., European, and private antitrust cases against Intel (which competes in a two-sided hardware platform market);

8 the Microsoft cases (U.S. and European authorities investigated multi-sided markets involving operating systems and other possible computer platforms);

9 the proposed merger of HoJobs and Monster.com (FTC investigated a two-sided market of online job services);

10 and probes into online broker-dealers (six separate U.S. regulatory investigations and one European investigation looked into anti-competitive behavior in two-sided e-dealer markets).

11 In some cases the multi-sided nature of the market was central to the allegations in the antitrust case,

12 while in others it provided an important backdrop for understanding the workings of the business.

13

Despite their economic importance, multi-sided markets have only recently received attention from economists and, with the exception of some recent work on payment cards, have received virtually no attention in the scholarly literature on antitrust.

14 This Article explains the economics of multi-sided platform markets and examines its implications for antitrust analysis. Part II defines the necessary conditions for the emergence of multi-sided platform businesses and then describes the profit-maximizing business strategies for these platforms. Part HI discusses the implications of these features of multi-sided markets for antitrust analysis. It shows how standard market definition, unilateral effects, predatory pricing, vertical restraints, and coordinated effects analyses must be modified to take into account the multi-sided nature of these markets. Part IV presents conclusions.

The economics of multi-sided platform markets brings to light a novel understanding of the pricing, production, and investment decisions of those businesses. A fundamental insight of the theoretical research is that these businesses need to determine an optimal pricing structure--one that balances the relative demands of the multiple customer groups--as well as optimal pricing levels. That insight has implications for many other strategic variables. Empirical examination of these industries finds that key business decisions are driven by the need to get critical levels of multiple customer groups on board and to balance complementary customer communities.

15 Antitrust analysis should always pay careful attention to the market context in which it is being applied. One size does not fit all. The theory and empirics of multi-sided platform markets provide guidance for the analysis of competitive practices in platform markets.

I. Economics of Multi-Sided Platform Markets

A. Necessary Conditions for the Emergence of a Platform Business

A platform can increase social surplus when three necessary conditions are met:

16

(1) There are two or more distinct groups of customers. In some cases, these customers are immutably different entities--men and women; shopping mall retailers and customers; individuals who have debit cards, merchants who take debit cards; software developers and software users. In other cases, these customers are different only for the purpose of the transaction at hand--eBay users are sometimes buyers, sometimes sellers; mobile phone users are sometimes callers, sometimes receivers. In many cases, members of customer group A consume a different product than members of customer group B; these products are related by the second condition.

(2)

There are externalities associated with customers A and B becoming connected or coordinated in some fashion. A shopper benefits when she can shop at her favorite retail store at the mall next door; a retailer benefits from being in a location that attracts such shoppers. A cardholder benefits when a merchant takes his card for payment; a merchant benefits when a cardholder has a form of payment he accepts. Although not necessary for a platform to arise, the presence of indirect network effects seems to explain empirically why a platform emerges. Indirect network effects

17 occur when the value obtained by one kind of customer increases with measures of the other kind of customer.

18 Video game developers value video game consoles more when they have more game users; game users value consoles that have more games. Sellers of antique harpoons value exchanges that have more people who would like to buy harpoons, and vice versa. Generally, in matchmaking markets customers of each type benefit from being able to search a larger group of customers of the other type for a suitable match. They also benefit from being able to search among a group that has been narrowed to suitable matches.

(3)

An intermediary is necessary to internalize the externalities created by one group for the other group. If the members of group

A and group

B could enter into bilateral transactions, they would be able to internalize the indirect externalities under Condition 2. Information and

transaction costs as well as free-riding make it difficult in practice for members of distinct customer groups to internalize the externalities on their own. This is especially true when the externalities arise from indirect network effects.

19 Men could in theory go around a singles bar and pay women to consider them as romantic prospects, but it tends not to happen.

The intermediary does not have to be a business in the usual sense; it could be an institution or set of rules. Consider paper money: It is more valuable to customers as a medium of exchange if more merchants take it and vice versa. Laws requiring that paper money be accepted to settle debts and institutions bolstering the government as a credible backer of paper money help get both sides on board.

20 The existence of indirect network externalities, however, provides profit opportunities for entrepreneurs to establish a platform that couples multiple customer groups. Exploiting these profit opportunities requires entrepreneurs to find pricing, product, and investment strategies to balance the interests of the many market sides.

21

An intermediary does not necessarily arise to solve the externality problem. Businesses may engage in tacit coordination. The music industry, for instance, manages to produce content for CDs, the CDs themselves, and the components to play CDs without much explicit coordination. In other cases, businesses may solve the problem through vertical integration into one side of the market. For example, Bill Gates faced the following problem at Microsoft: "In 1989, I personally went to all the applications developers and asked them to write applications for Microsoft Windows. They wouldn't do it."

22 His solution was simple: "So I went to the Microsoft Applications Group, and they didn't have that option."

23 Even today, when the Windows operating system is a well-established platform, Microsoft continues to produce some of the most important applications for Windows.

24

Determining when indirect network effects result in the formation of a platform business and whether platforms (versus tacit coordination or integration) are a more socially efficient method for dealing with these effects would be a rewarding topic for further research. This Article, however, focuses on industries in which platform businesses are the dominant mode of organization for internalizing externalities.

B. Types of Multi-Sided Platform Businesses

There are three major kinds of multi-sided platforms: (1)

Market-Makers enable members of distinct groups to transact with each other. Each member of a group values the service more highly if there are more members of the other group, thereby increasing the likelihood of a match and reducing the time it takes to find an acceptable match. Shopping malls, for example, are more valuable to customers if there are more retail shops at which they can make purchases and more valuable to retail shops if there are more customers who are likely to buy their products.

25 Not surprisingly, shopping mall developers try to create "upscale" or "downscale" malls to match customers and shops.

26 EBay started out as a meeting place for people who wanted to buy or sell Pez dispensers.

27 It has grown to provide a meeting place for people who want to buy or sell many different kinds of goods.

28 Much of its efforts have gone into improving the quality of the match by, for example, aggregating information on repeat sellers from buyers.

29 NASDAQ and dating services such as Yahoo! Personals are similar examples of market-makers.

30

(2)

Audience-Makers match advertisers to audiences. Advertisers value a service more if there are more members of an audience who will react positively to their messages; audiences value a service more if there is more useful "content" provided by audience-makers.

31 Advertising- supported media such as magazines, newspapers, free television, yellow pages, and many Internet portals are audience makers.

32 Yellow pages, for example, are more valuable to customers if more companies provide information and are more valuable to companies if more customers see the messages.

33 Free television is more valuable to advertisers if there are more viewers. Like many media, though, viewers come mainly for the "content"--the shows--and view the advertisements because it is too costly to avoid them.

34

(3)

Demand-Coordinators make goods and services that generate indirect network effects across two or more groups. These platforms do not strictly sell "transactions" like a market maker or "messages" like an audience-maker; they are a residual category much like irregular verbs-- numerous, heterogeneous, and important. Software platforms such as Windows and the Palm OS, payment systems such as credit cards, and mobile telephones are demand coordinators.

35 Payment card platforms, for example, enable cardholders and merchants to consummate transactions using a payment card. This involves providing distinct services to cardholders and merchants designed to stimulate demand for the card. For example, even without using financing features, cardholders receive credit services since they have several weeks to pay for a purchase with most credit and charge cards, and merchants also often receive detailed accounting information.

36 Software platforms coordinate users and developers. The platform includes features that many software developers and end users want to avail themselves of and therefore economizes on the production of these features.

37 Such features are more valuable to developers if more computer users rely on the platform and are more valuable to computer users if more applications run on the platform.

38

Table 1 provides further examples of multi-sided platform markets and businesses that participate in these markets. While by no means exhaustive, it illustrates the variety of multi-sided platform industries.

C. Multi-Sided Versus Single-Sided Markets

Since most markets have distinct consumer types--teenagers or retirees, households or businesses, men or women--can existing theories fully explain the economics of platform businesses and multi-sided markets? Multi-sided markets differ from the traditional single-sided markets because platform businesses have to serve two or more of these distinct types of consumers to generate demand from any of them. Hair salons can cater to men, women, or both. Heterosexual dating clubs have to cater to men and women.

Methods of price discrimination provide another useful comparison between single-sided and multi-sided markets. Businesses in single-sided V,

) and multi-sided markets engage in price discrimination because it is possible to increase revenue by doing so and because, in the case of businesses with extensive scale economies, it may be the only way to cover fixed costs.

39 A dating club may charge men a higher price just because they have more inelastic demand and because it is easy to identify consumers on the basis of sex.

40 But businesses in multi-sided markets

Table 1. Sources of Platform Revenue in Selected Two-Sided Platforms

| Industry | Two-Sided Platform | Side One | Side Two | Side that Gets Charged Little | Sources of Revenue |

| Real Estate | Residential Property Brokerage | Buyer | Seller | Side One | Real estate brokers derive income principally from sales commissions.1 |

| Real Estate | Apartment Brokerage | Renter | Owner/ Landlord | Typically Side One | Apartment consultants and locater services generally receive all of their revenue from the apartment lessors once they have successfully found tenants for the landlord.2 |

| Media | Newspapers and Magazines | Reader | Advertiser | Side One | Approximately 80 percent of newspaper revenue comes from advertisers.3 |

| Media | Network Television | Viewer | Advertiser | Side One | For example, the FOX television network earns its revenues primarily from advertisers.4 |

| Media | Portals and Web Pages | Web "Surfer" | . Advertiser | Side One | For example, Yahoo! earns 75 percent of its revenues from advertising.5 |

| Software | Operating

System | Application

User | Application

Developer | Side Two | For example, Microsoft earns at least 67 percent of its revenues from licensing packaged software to end-users.6 |

| Software | Video Game

Console | Game

Player | Game

Developer | Neither--

Both sides are a significant source of platform revenue. | Both game sales to end users and licensing to third party developers are significant sources of revenue for console manufacturers.7 Console manufacturers have sold their video game consoles near or below marginal cost (not taking into account research and development). Microsoft, for instance, is selling its Xbox for at least $125 below marginal cost.8 |

Payment

Card

System | Credit Card | Cardholder | Merchant | Side One | For example, in 2001, American Express earned 82 percent of its revenues from merchants, excluding finance charge revenue.9 |

Sources:

(1) U.S. DEPARTMENT OF LABOR, BUREAU OF Labor Statistics,

Real Estate Brokers and Sales Agents, in OCCUPATIONAL OUTLOOK HANDBOOK,

available athttp://www.bls.Bov/oco/ocosl20.htni (last visited Sept. 3, 2002);

(2) Courtney Ronan,

Apartment Locaters: How Do They Make Their Money?, Realty Times, June 30, 1998,

athttp://realtvtimes.eom/rtnews/rtcpages/l 9980630 aptlocator.htm (last visited Aug. 22, 2002);

(3) LISA George & Joel Waldfogel, Whom Benefits Whom in Daily Newspaper Markets? 11 (Nat'l Bur. Econ. Research, Working Paper No. 7944,2000);

(4) FOX Entm't Group, 2000 Annual Report 26,

available at http://www.newscorp.com/feg/foxReport2000/fin m d a.html: (5) Yahoo!, 2001 Annual Report 29,

available athttp://docs.yahoo.com/info/investor/ai01/yahoo ar2001 .pdf:

(6) IDC, 1994 Worldwide Software Review and Forecast (IDC 9358, Nov. 1994); IDC, 1995 Worldwide Software Review and Forecast (IDC 10460, Nov. 1995); IDC, 1996 Worldwide Software Review and Forecast (IDC 12408, Nov. 1996); IDC, 1997 Worldwide Software Review and Forecast (IDC 14327, Oct. 1997); IDC, 1999 Worldwide Software Review and Forecast (IDC 20161, Oct. 1999); IDC, Worldwide Software Market Forecast Summary, 2001-2005 (IDC 25569, Sept. 2001);

(7) David Becker,

Revenue from Game Consoles will Plunge, Report Predicts, CNET.COM, Jul. 31, 2000,

at http://techrepub1ic-cnet.com.com/2100-1040-243841 .htm1?legacy=cnet (last visited Aug. 5, 2002);

(8) Rob Fahey,

MS to Lose £525Mon Xbox This Year,Gamelndustry.biz, June 26,2002,

at http://www.gamesindustrv.biz/content page,php?section name=pub&aid=210: (9) American Express Company, 2001 Annual Report 35,

available at http://www.onlineproxv.com/amex/2002/ar/pdf/axp_ar_2001.pdf (last visited Aug. 15,2002).

have an additional reason: By charging one group a lower price the business can charge another group a higher price; and unless prices are low enough to attract enough of the former group, the business cannot obtain sales at all.

41 A dating club has a reason to charge men a higher price if too many men show up compared to women at equal prices.

42

Like firms in multi-sided markets, many firms in single-sided markets sell multiple products, and there is an extensive economic literature explaining why they do so.

43 On the cost side, there may be economies of scope from having one firm produce multiple products. Automobile manufacturers can use the same production technology for making cars and trucks. American Express can use the same computer system for providing services to cardholders and merchants. On the demand side, there are advantages to pricing complementary products together.

44 These standard explanations for why firms produce multiple products probably apply to many of the platforms discussed here. But firms that make multiple products for several one-sided markets (e.g., General Electric makes light bulbs and turbine engines

45) or several complementary products for a distinct set of consumers (e.g., IBM sells computer hardware and computer services

46) do not secure profit opportunities from internalizing indirect network effects.

Multi-sided platform markets, on the other hand, are subject to indirect network effects. A lengthy literature in economics, dating back to the mid-1980s, analyzes the economic implication of these effects.

47 That literature considers first-mover advantages,

48 the difficulties of coordinating the production of complementary products,

49 and problems that result from markets tipping to a possibly bad technology or having so much inertia that they cannot move to a better technology.

50 The literature does not, however, consider the economics of businesses that harness these indirect network effects through the creation of a multi-sided platform.

51Related work examines the role of cooperation among businesses to produce complements but does not consider the role of platform businesses as such.

52

D. Profit-Maximizing Pricing by Multi-Sided Platform Businesses

The special problems that platform firms must solve are best developed by considering their pricing strategies. To simplify the terminology, consider a two-sided market in which both sides are purchasing goods that have the same metric--such as a transaction or a date.

53 The platform business faces two demand curves, each of which depends on the quality-adjusted quantity purchased on the other side. The platform incurs a fixed cost for operating the platform and variable costs for servicing each side.

The optimal price for side A depends on the responsiveness of demand to changes in price on side A, the responsiveness of demand on side B to changes in quality-adjusted sales on side A, and changes in variable costs on both sides. To see this, suppose we have found the optimal prices for sides A and B. An increase from the optimal price on side A, holding the optimal price on side B constant, will have the following effects: Demand on side A will fall, demand on side B will fall since side 5's product is less valuable, variable costs will fall on side A and variable costs will fall on side B. Therefore, all of those factors have to be taken into account when searching for the optimal price pair. (The same intuition applies to discovering the social welfare-maximizing price.)

- Pricing by a Multi-Sided Platform Facing Multiplicative Demand

All of the theoretical models of pricing by platforms in multi-sided markets confirm this intuition.

54 Here we consider the Rochet-Tirole model, which is motivated by payment cards. The model assumes that the total demand facing the platform increases proportionately with the number of merchants and the number of cardholders. A simple regression provides some support for this assumption. Based on annual data from 1981 to 2001 for Visa, a regression of the log of the number of transactions against the log of the number of merchants and the log of the number of cardholders yields:

55

log(transactions) = -8.49 + 1.73 • log(merchants) + 0.84 • log(cardholders)

A coefficient of 1 on each variable would indicate that transactions were exactly proportional to the relevant variable. These results indicate that transactions increase somewhat more than proportionately with the number of merchants and just slightly less than proportionately with the number of cardholders.

56 This model also describes many matchmaking services.

57 More dates will result when there are more men and women in a club. More transactions will take place on exchanges that have more buyers and sellers.

While the results do not fit the Rochet-Tirole formulation precisely, they suggest that a multiplicative demand function is a reasonable simplifying assumption. Specifically, the Rochet-Tirole model assumes total demand,DT, is given by:

DT = D1(p1)xD2(p2) (1)

Here, the subscripts indicate the respective sides of the market, so that

D1(p1)denotes the demand on side 1 of the market, which depends on the price on side 1, and similarly for side 2. Although simple, this demand structure captures the key interaction between the two market sides from the standpoint of the platform. More complex and realistic demand structures would be less tractable but would yield qualitatively similar results.

58 In particular, making one side's demand depend on the demand for the other side would strengthen the result, presented below, that relative prices between the two sides depend on relative demand, not on costs.

59

Rochet and Tirole assume that there is a per unit (variable) cost of a transaction equal to c. Note that this variable cost is incurred when a transaction takes place and is therefore not attributable to either side alone. In fact, much of the costs of payment card transactions is either joint, in the sense that the costs arise when a transaction occurs (the cost of authorization and settlement), or the allocation of costs to one side or the other is economically arbitrary (the cost of funds, charge-offs, fraud, and other risks).

60

The first condition in Rochet-Tirole for a monopolist in a two-sided market is that the total price,

pT, is given by.

61

Here c is the per unit (variable) cost of a transaction on the platform, and

pT is equal to the sum of

p1 and p2. The expression on the left-hand side gives the total price-cost margin charged by the firm. The term

n on the right-hand side is a measure of "elasticity" or the responsiveness of demand on the two sides to changes in price.

62 The condition indicates that, as the responsiveness of demand increases, the price-cost margin falls. Roughly speaking, as consumer sensitivity to prices increases, the price a monopolist gets to charge falls.

This result is analogous to the familiar Lerner condition for monopoly pricing in one-sided markets.

63 As far as the overall price level is concerned, two-sided pricing is similar to one-sided pricing. The difference, however, is that two-sided pricing must involve a price structure that divides total price between the two sides of the system. Consider the impact on total demand from a small change in the price of, for example, side 1. With proportional demand, the change in total demand is proportional to the percent change in demand on side 1:

64

If a monopolist is maximizing profits, it must be unable to do better by raising prices slightly on one side and decreasing prices by the same amount on the other side. That is, the impact on total demand must be the same from changing prices on either side. Equation 3 above implies that the percentage change in demand on each side must be equal, because total demand will change by exactly that percentage. Formally, this means that:

65

In equilibrium, the ratio of the prices on the two sides is proportional to the ratio of the elasticities of demand on the two sides.

66

The most important thing to notice is that Equation 4 does not depend on variable costs. Consequently, the prices charged to either side do not depend directly on the variable cost; they only depend on variable cost through the apportionment of the total price. This is a very different result than pricing in one-sided markets. For example, in one-sided markets with heterogeneous customers, businesses might charge different prices. Each of those prices follows some variant of the Lerner condition, where the price-cost margin is inversely proportional to the elasticity of demand.

67 Even pricing in multiproduct firms follows some variant of the Lerner condition.

68 The key result of the economics of multi-sided platforms is that the Lerner condition does not hold and, consequently, the profit-maximizing price of a product does not vary directly with the marginal cost of product--an otherwise robust result of most economic theories of pricing.

69

- The Pricing Structure and Indirect Network Externalities

Using a model in which the demand by one side is an increasing function of the demand on the other side, Geoffrey Parker and Marshall Van Alstyne show that the relative pricing structure is determined by the relative indirect network externalities on each side.

70 If there are strong indirect network externalities on both sides, then it will appear as if the platform business is ignoring them--as it should because they tend to cancel out. The side with much lower indirect network externalities is more likely to receive "lower prices" compared with the side with greater indirect network externalities.

71

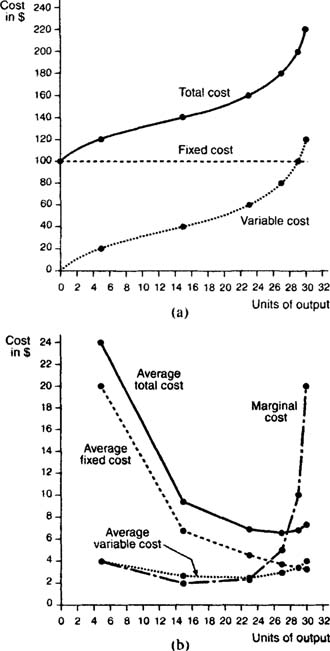

Figure 1, drawn from Parker and Van Alstyne's analysis, describes three possible equilibria for a monopoly platform. Panels A through C show the change in prices for the two sides as the externality from side 2 to side 1 increases. The two lines in each panel are the firm's optimal choice of price on one side given a price on the other side--the intersection is the optimal pair for the firm at a given level of externalities between the two sides. The results in Panels A through C show that as the effect of side 2 demand on side 1 demand increases, the price on side 2 decreases. Intuitively, this is because it becomes more profitable for the firm to "subsidize" price cuts on side 2 if the resulting impact on demand on side 1 is greater. We see in Panel A, where the externalities are equal between the two sides, that prices are symmetric. As the externality from

Figure 1. Possible Equilibria for a Monopoly Platform

Note: PI refers to side 1, and P2 to side 2. Panel A shows a symmetric positive price equilibrium, Panel B shows an asymmetric positive price equilibrium, and Panel C shows a positive/negative price equilibrium.

Source: Geoffrey G. Parker & Marshall W. Van Alstyne, Unbundling in the Presence of Network Externalities 13 (Aug. 31, 2002) (unpublished manuscript, on file with Yale Journal on Regulation) (notation changed from original for ease of exposition).

side 2 to side 1 increases, as in Panel B, the price on side 2 decreases and the price on side 1 increases. In Panel C, where the externality from side 2 to side 1 is even greater, we see that it actually makes sense for the firm to set a negative price on side 2 because of the benefits from stimulating demand on side 1.

An important result is that the profit-maximizing price structure can include a negative price on one side.

72 This is similar to the familiar razor and blade result but arises for a different reason. The razor and blade are complementary products for an individual consumer. The blade seller stimulates demand for blades by giving the razor away to the consumer. In multi-sided platform markets, it is possible that one group of consumers will get a product for free (or be paid to take it) so that the platform can, in effect, deliver this group of consumers to the consumers on the other side(s). I will return to this result in the discussion of predatory pricing in Part II.C.

- The Relationship Between Prices and Costs

The relationship between prices and costs in platform businesses is worth dwelling on since it will prove important for analyzing antitrust and other public policies. It is well recognized by economists that in multi-product businesses the allocation of joint costs to a particular product is arbitrary and that there is no economic rationale behind any proposed formula for doing so.

73 That proposition is also true for fixed costs that platform businesses incur for a product or service on just one side of the market. Incurring these fixed costs enables the business to provide a product or service that creates demand on the other side. In fact, in some cases incurring these fixed costs may be essential for there to be any demand on the other side. Thus, calculations of profit (such as gross operating margins) based on allocations of fixed costs--either joint or side-specific--are necessarily arbitrary. Price-marginal cost relationships for one side do not have any economic meaning either. By themselves they do not guide the business to profit-maximizing prices or regulators to social-welfare-maximizing prices. One needs to consider prices and marginal costs on all sides jointly (along with demand characteristics). The platform faces a challenging optimization problem, and the regulator an onerous information problem.

- Pricing with Platform Competition

Pricing considerations are broadly similar when there are competing firms selling to multiple sides of the market.

74 Rochet and Tirole consider an interesting case of this, which they refer to as "multihoming"

75-- consumers on one or more sides of the market rely on more than one seller of multi-sided services.

76 Most platforms face competition on at least one side, as noted in Table 2, so multihoming is prevalent. Many cardholders have cards issued by and many merchants accept cards from several competing platforms--an example of multihoming on both sides.

77 Developers of applications for operating systems or game consoles generally write for multiple platforms, while most people use only one computer operating system or game console--an example of multihoming on just one side.

78

Multihoming affects both the price level and the pricing structure. Not surprisingly, the price level tends to be lower with multihoming because the availability of substitutes tends to put pressure on the multi-sided firms to lower their prices.

79 The seller has more options when dealing with a multihomed buyer on the other side and can select its preferred platform. As buyer multihoming becomes more prevalent, prices to sellers will tend to decrease since they have more substitution options. Even when multihoming is not observed on one side of a multi-sided market, the possibility of multihoming may have significant consequences for pricing. The possibility of multihoming may encourage firms to lower their prices on the side of the market in which multihoming could occur. By lowering their prices, they discourage customers on that side from affiliating with other multi-sided firms.

80 This is not entirely a free lunch for consumers. The firm can then charge more to customers on the other side(s), for whom fewer substitutes are available.

81

Table 2: The Presence of Multihoming in Selected Two-Sided

Platforms

Two-Sided

Platform | Presence of Multihoming for Side

One | Presence of Multihoming for Side

Two |

Residential

Property

Brokerage | Buyer--Uncommon: Multihoming may be unnecessary, since a Multiple Listing Service ("MLS") allows buyers to see property listed by all member agencies.1 | Seller--Uncommon: Multihoming may be unnecessary, since an MLS allows the listed property to be seen by all member agencies' customers.1 |

Securities

Brokerage | Buyer--Common: The average securities brokerage client has accounts at three firms.2 Note that clients can be either or both buyers or sellers. | Seller--Common: The average securities brokerage client has accounts at three firms.2 As mentioned, clients can te either or both buyers or sellers. |

| B2B | Buyer--Varies: For example, multihoming may be unnecessary for some online B2B sites, since buyers can go directly to the B2B platform instead of contacting multiple individual suppliers.3 | Seller--Varies: Multihoming may be unnecessary since the B2B can inexpensively reach a large audience.4 |

| P2P | Buyer--Varies: Multihoming may be unnecessary for buyers using online auction sites since eBay holds 85% of the market share (i.e. it seems that most people purchase their online auction products at eBay).5 Alternatively, multihoming may be more common for online dating services where there are many sites and a large audience of online singles (considered to be available singles, as opposed to buyers).6 | Seller--Varies: Multihoming may be unnecessary for sellers using online auction sites since eBay holds 85% of the market share (i.e. it seems that most people auction their products at eBay).5Alternatively, multihoming may be more common for online dating services where there are many sites and a large audience of online singles (considered to be available singles, as opposed to sellers).6 |

Newspapers

and

Magazines | Reader--Common: In 1996, the average number of magazine issues read per person per month was 12.3.7 | Advertiser--Common: For example, Sprint advertised in the New York Times, Wall Street Journal, and Chicago Tribune, among many other newspapers, on Aug. 20, 2002. 8 |

Network

Television | Viewer--Common: For example, Boston, Chicago, Los Angeles, and Houston, among other major metropolitan areas, have access to at least four main network television channels: ABC, CBS, FOX, and NBC.9 | Advertiser--Common: For example, Sprint places television advertisements on ABC, CBS, FOX, and NBC.10 |

Operating

System | Application User--Uncommon: Individuals typically use only one operating system.11 | Application Developer--Common: As noted earlier, the number of developers that develop for various operating systems indicates that developers engage in significant multihoming.12 |

Video

Game

Console | Game Player--Varies: A household hat already owns at least one console on average owns 1.4 consoles.13 | Game Developer--Common: For example, Electronic Arts, a game developer, develops for Nintendo's GameCube, Microsoft's Xbox, and Sony's PlayStation 2, among other consoles.14 |

Payment

Card | Cardholder--Common: Most American Express cardholders also carry at least one Visa or MasterCard.15 | Merchant--Common: American Express cardholders can use Visa and MasterCard at almost all places that take American Express.15 |

Sources:

(1) James R. Frew & G. Donald Jud,

Who Pays the Real Estate Broker's Commission?, in Research in Law and Economics: The Economics of Urban Property RIGHTS 177, 178 (Austin J. Jaffe & Richard O. Zerbe, Jr. eds., 1987);

(2) Susan Scherreik,

Is Your Broker Leaving You Out in the Cold?, BUSINESS WEEK ONLINE, Feb. 18, 2002,

http://www.businessweek.com/mapazine/content/02 07/b3770110.htm (last visited Aug. 22, 2002);

(3) David Lucking-Reilly & Daniel F. Spulber,

Business-to-Business Electronic Commerce, J. ECON. PERSPECTIVES, Winter 2001, at 57-58;

(4) FED. TRADE COMM'N,

Efficiencies of B2B Electronic Marketplaces, in 2 ENTERING THE 21ST CENTURY: Competition Policy in the World of B2B Electronic Marketplaces 5 (Oct. 2000),

available athttp://www.ftc.gov/os/2000/10/index.htmtf26 (last visited Aug. 14, 2002);

(5) Oscar S. Cisneros,

EBay Accused of Monopolization, Wired NEWS, July 31, 2000,

http://www.wired.eom/news/print/0.1294.37871.00.html (last visited Aug. 20, 2002);

(6) Paul Festa,

Looking for Love Online, CNETNEWS.COM, Dec. 17,1996,

http://news.com.com/2100-1023-255523.html?tag=m (last visited Aug. 22, 2002);

(7) FOOTE, CONE & BELDING MEDIA Research Report, Magazines in the Information Age (Spring 1998),

at http://www.magazine.org/resources/research/fcb magazines infoage.html (last visited Apr. 12, 2003);

(8) Sprint, Advertisement, Chi. Trb., Aug. 20,2002, § 1, at 11; Sprint, Advertisement, N. Y. TIMES, Aug. 20, 2002, at A20; Sprint; Advertisement, WALL ST. J., Aug. 20, 2002, at A15;

(9) ABC.com, Local Stations,

http://abc.abcnews.go.com/site/localstations.html (last visited Sept. 3, 2002); CBSNEWS.com, Local CBS Affiliates,

http://www.cbsnews.com/stories/2002/07/31/utility/main517034.shtml (last visited Apr. 12, 2002); F0X.com, FOX Affiliates,

http://www.fox.com/links/affiliates.htm (last visited Sept. 3, 2002); NBC.com, Local Stations,

http://www.nhc.com/nbc/header/Local_ Stations/ (last visited Sept. 3, 2002);

(10) Press Release, James Fisher, Sprint, An Ad Blitz for the 21st Century (Sept. 24, 1997),

http://www3.sprint.com/PR/CDA/PR CDA Press Releases Detai1/0.3245..00.html?ID=1294 (last visited Aug. 23, 2002);

(11) Scot Hacker,

He Who Controls the Bootloader, BYTE.COM, Aug. 27, 2001,

at http://journals2.iranscience.net: 800/www.byte.com/www.byte.com/ documents/s=1115/byt20010824s0001/default.htm (last visited Aug. 20, 2002);

(12) Josh Lerner, Did Microsoft Deter Software Innovation? 31, (May 28, 2001) (unpublished manuscript, on file with the Yale Journal on Regulation),

available at http://papers.ssrn.com/sol3/papers.cfm7abstract id=269498:

(13)

Yankee Group: Video-Game Penetration Grows to 36 Million Households in 2001, REUTERS NEWS, Nov. 19, 2001,

http://about.reuters.com/newsreleases/art 19-11-2001 id785.asp (last visited Aug. 30, 2002);

(14) Electronic Arts Inc., 2002 SEC Form 10-K, at 3 (June 28, 2002);

(15) David S. Evans & Richard Schmalensee, Paying with Plastic: The Digital Revolution in Buying and Borrowing 170 (1999).

- Complexity and Dynamics

The above economic analysis highlights two important aspects of platform businesses. Complexity is the first. Firms in single-sided markets have to search for the best price level which, at a purely theoretical level, is an easy informational hurdle to surmount. Firms can adjust price, observe the effect on sales, and measure the direct correspondence to production costs. Firms in multi-sided markets, however, have to search for two or more interdependent price levels and discern the interaction effects. They also have to worry about instabilities: Seemingly small changes on one side can have dramatic changes on the other side due to the resulting interactions. For example, Yahoo operated an Internet auction site that, in 2000, was second only to eBay in number of listings. It was able to reach that level because, unlike eBay, Yahoo did not charge sellers a fee for listing their products. When Yahoo attempted to charge sellers for listings in early 2001, its listings fell by ninety percent, leaving little for buyers to bid on.

82 Presumably, sellers concluded that if they had to pay for offering a product in an online auction, they would be better off focusing on the largest venue, eBay.

Not surprisingly, many successful platform businesses have developed gradually through a process of trial and error. For example, Diners' Club--the first charge card that could be used at multiple merchants--began by providing a card product for paying at restaurants in New York. It expanded the restaurant model to Los Angeles, and then to travel and entertainment businesses nationwide.

83 EBay--while operating on Internet time--expanded from Pez dispensers to more than 18,000 item categories sold worldwide.

84 Examples of the reverse situation, in which businesses have gotten their structure wrong, are readily available. B2B exchanges invested in substantial infrastructures to make markets, established a pricing scheme, and opened to find few takers.

85

The practical complexity of getting all sides on board may explain why real-world multi-sided platform markets do not appear "tippy." Some economists argued from theory that customers would stampede toward the network with the greatest number of members. Therefore, if one network got even a small lead over another network the market would tip to the former, which would then achieve ubiquity.

86 In practice, successful multi-sided platforms evolve relatively slowly as businesses grope for the optimal pricing structure and gradually develop customers on all sides of the market.

87 Aspiring platforms that have heeded the prescriptive advice of network economics--build share early and quickly--have not done well.

88

Critical mass is the second important challenge for platform businesses and is a key start-up issue. Known in the literature as the chicken-and-egg problem, the name does not do the problem justice. In some situations coupled products cannot come into existence without a sufficient number of customers on both sides from the start. Payment cards are the clearest example: The card is worthless to individuals if few merchants take it and is worthless to merchants if few individuals use it. Among electronic exchanges, the B2B platform discussed above is again relevant, since neither buyers nor sellers showed up in sufficient numbers to make either side interested.

89

Sometimes, though, platforms can evolve sequentially by providing products and services to build up one customer base before pursuing the second. The evolution of Microsoft's software platform is an example. The early versions of DOS offered relatively few services to applications developers. Over time the base of computer owners who used Microsoft's operating system software expanded, making it attractive for software developers to use this operating system and for Microsoft to add features they could use.

90

E. Pricing Structures and Strategies

Many platform companies settle on pricing structures that are heavily skewed towards one side of the market. Table 1 summarizes the pricing structure for selected multi-sided platforms. For example, in 2001 American Express earned eighty-two percent of its revenues from merchants, excluding finance charge revenue.

91 Microsoft earns the substantial majority of its Windows revenue from licensing the operating system to computer manufacturers or end users.

92 Shopping malls earn virtually all their revenues from leasing space; not only do they not charge for admittance, they sometimes offer free parking and other amenities.

Zero or negative prices also appear as suggested by the multi-sided platform theory.

93 The pure case involves platforms such as Adobe, which gives away its reader software--for which it incurs some cost--to increase the demand for its production software.

94 Impure cases involve platforms such as RealNetworks, which gives a basic version of its player away to users but collects some revenues from individuals who want more features. However, the fraction of users paying for the premium edition is small-- only 1.4 percent of the user base in 2000.

95 Similarly, Apple gives away the basic QuickTime Player while charging for the premium edition.

96

Zero or negative prices are especially likely at the entry phase to get critical mass on one side of the market.

97 Diners Club gave its charge card away to cardholders at first; there was no annual fee, and users received the benefit of the float.

98 Netscape gave away its browser to most users to get a critical mass on the computer user side of the market; after Microsoft started giving away its browser to all users Netscape followed suit.

99 Microsoft is reportedly subsidizing the sales of its X-box hardware to consumers to get them on board.

100

Sometimes all the platforms converge on the same pricing strategy. Microsoft, Apple, IBM, Palm, and other operating system companies could have charged higher fees to applications developers and lower fees to end users. They all discovered that it made sense to charge developers relatively modest fees for developer kits and, especially in the case of Microsoft, to give a lot away for free. Nevertheless, Microsoft is known for putting far more effort into the developer side of the business than the other operating system companies.

101 To take another example, in the battle between Microsoft and Netscape over Internet browsers, Microsoft gave away developer kits to Internet portals, while Netscape charged for them.

102

The debit card is an example in which different platforms made different pricing choices because they had different customers on board when they entered. In the late 1980s, ATM networks had a base of cardholders who used their cards to withdraw cash or obtain other services at ATMs. They had no merchants that took these cards. To add debit services to existing ATM cards, ATM networks charged a smaller interchange fee than did credit card systems to encourage merchants to install PIN pads. Compared to credit card systems' interchange fee of 38 cents on a typical $30 transaction, ATM networks only charged 8 cents.

103 (On debit and credit transactions, the interchange fee is paid by the merchant's bank to the cardholder's bank. A lower interchange fee will tend to lower prices on the merchant's side and to raise them on the cardholder's side.) The PIN pads merchants installed could read the ATM cards that cardholders already had and accept the PINs they used to access ATMs.

104 In response to ATM networks' low interchange fee, many merchants invested in the PIN pads, whose numbers increased from 53,000 in 1990 to about 3.6 million in 2001.

105 In contrast to the credit card systems, which already had a base of merchants who took their cards and consumers who used them, ATM systems had to persuade banks to issue debit cards and cardholders to take these cards.

106 Their strategy worked: The number of Visa debit cards in circulation increased from 7.6 million in 1990 to about 117 million in 2001.

107

Two other factors besides market share appear to affect the pricing structure of platform businesses. There may be certain customers on one side of the market--Rochet and Tirole refer to them as "marquee buyers"

108--that are extremely valuable to customers on the other side of the market. The existence of marquee buyers tends to reduce the price to all buyers and increase it to sellers. For example, American Express has been able to charge a relatively high price to merchants as compared to other card brands, because merchants viewed the American Express business clientele as extremely attractive. Corporate expense clients were "marquee" customers that allowed American Express to raise its prices to the other side of the market, merchants.

109

A similar phenomenon occurs when certain customers are extremely loyal to the platform business--perhaps because of long-term contracts or sunk-cost investments. In the case of the ATM networks, however, card issuers faced "captive" customers--ATM cards could be used as online debit cards, so consumers did not need to be courted to accept the new payment form. Therefore, it has been the merchants--who must purchase and install expensive machinery in order to process online debit transactions--who have been courted, as we saw above.

Skewed pricing structures are not the only way to obtain critical mass. Platforms sometimes invest in one side of the market to lower the costs of participation for consumers on that side of the market. Microsoft provides a good example of this. It invests in applications developers by developing tools that help them write applications and providing other assistance that makes it easier to write applications using Microsoft operating systems.

110 To take another example, bond dealers take positions in their personal accounts for certain bonds they trade. They do this when the bond is thinly traded and the long time delays between buys and sells would hinder the market's pricing and/or liquidity. By investing in this manner, multi-sided intermediaries are able to cultivate (or even initially supply) one side, or many sides, of their market in order to boost the overall success of the platform. Another effect of providing benefits to one side is that this assistance can discourage use of competing platform firms. For example, when Palm provides free tools and support to PDA applications software developers, it encourages those developers to write programs that work on the Palm OS platform, but it also induces those developers to spend less time writing programs for other operating systems.

111

F. Multi-Sided Markets and Social Welfare

In practice, a relatively small number of firms tend to compete in multi-sided platform markets because of indirect network effects on the demand side and fixed costs of establishing platforms. The benefits of demand and cost-side scale economies are often limited, however, by the existence of heterogeneous customers on one side of the market. As a result, we see few firms in each market, but also few monopolies.

The consequences of having relatively few competitors in multi-sided markets, and the existence of network effects, raise familiar issues concerning the efficacy of competitive markets and the possibility of a role for government intervention. However, the pricing and investment strategies that firms in multi-sided markets use to "get all sides on board" and "balance the interests of all sides" raise novel issues. One issue is whether the relative prices adopted by multi-sided firms--which in practice often result in one side seemingly subsidizing the other side--are socially inefficient.

In an admittedly simplified setting, Rochet and Tirole analyze the pricing structure--relative prices as opposed to absolute prices--adopted by firms in two-sided markets as compared to the pricing structure that would maximize social welfare. They find that a firm with a monopoly, a firm with competition, and a benevolent social planner would all adopt similar pricing structures. The precise relative prices would differ somewhat.

112However, Rochet and Tirole find that the relative prices chosen by a monopoly and competing platforms are not biased toward one side or the other compared to the pricing structure a benevolent social planner would adopt.

113 (Schmalensee finds similar results for interchange fees.

114) There is no reason to believe that charging one side of the market relatively low prices and the other side relatively high prices is inefficient in and of itself.

Nevertheless, firms in concentrated multi-sided markets have the same opportunities as firms in concentrated single-sided markets to establish price levels that permit them to earn supra-competitive profits-- i.e., profits that exceed those necessary to attract capital to the industry after accounting for risk. In multi-sided markets as in single-sided markets, however, the relevant measure is ex ante rather than ex post profits: Did the business have risk-adjusted expected profits that exceeded competitive levels upon entry? One day Amazon.com and eBay may be extremely profitable companies. If that day comes one should ignore neither the losses they incurred nor the risk they faced in getting to that point; the risk is reflected in the multitude of failures by other companies that attempted to create similar platforms, failed, and caused massive financial losses for their investors.

115

II. Antitrust Analysis of Multi-Sided Platform Markets

The economics of multi-sided markets differs from the economics of single-sided markets in important respects. First, the individual prices charged on each side of the market do not track costs or demand on that side of the market. The fact that benefits and costs arise jointly in multiple sides of the market implies that there is no meaningful economic relationship between benefits and costs on each side of the market considered alone. Second, one cannot talk about the individual prices in isolation. Any change in demand or cost on one side of the market will necessarily affect the level and relationship of prices on all sides. Third, products in multi-sided markets may not be able to come into existence unless firms in those markets get all sides on board. This gives rise to pricing and investment strategies that differ from those taken in one-sided markets and seem odd unless considered in the context of multi-sided market competition. Fourth, any analysis of social welfare must account for the pricing level, the pricing structure, and the feasible alternatives for getting all sides on board. It must also account for the possible role of not-for-profit institutions such as standards setting bodies and cooperatives.

These differences matter for antitrust analysis. Considering them will avoid the error of condemning procompetitive behavior. It is important to emphasize that multi-sided platform markets are no more or less susceptible to anti-competitive conduct than are single-sided markets. There are, however, opportunities for different kinds of anti-competitive conduct in multi-sided platform markets than in others. For example firms can engage in tactics on one side--such as exclusive contracts--that could increase their market power on all sides. There are also markets where the economics of platform businesses suggests that certain practices that may appear anti-competitive--recouping losses from "low prices" on one side through "high prices" on the other side--are natural, pro-competitive practices. Market definition, to which we now turn, is another important area where the economics of multi-sided markets change the standard analysis. One needs to take the multi-sided nature of platform businesses into account to determine market boundaries, but doing so does not have any uniform effect on whether a merger in a platform business should be considered pro-competitive or anti-competitive.

A. Market Definition and the Evaluation of Market Power

- Market Definition

The general purpose of market definition is to provide a context for examining the issues that arise in an antitrust matter.

116 For cases involving alleged anti-competitive conduct, market definition helps to determine whether the defendant has enough market power to engage in certain anticompetitive tactics and whether those tactics will result in an increase in or maintenance of its market power. For merger cases, market definition helps to identify the firms that could constrain possible price increases by the merging parties and thereby helps to determine whether the merging parties will realize a significant increase in their market power. Often, market definition determines whether a firm's product is in the market or out of the market by looking at substitution in demand or supply.

117 The degree of competitiveness of the market is then assessed by calculating the distribution of market shares that participants hold, the Herfindhal-Hirschman Index ("HHI") being a commonly used measure.

118 A firm's market share is often taken as a proxy for its market power.

The U.S. Department of Justice and Federal Trade Commission, along with several economists, take a standard, mechanical approach to determining whether a firm is in the market.

119 They start with the firm(s) under consideration and add competitors to the market. The market boundary results (in a geographic or product dimension) when the collection of firms could, acting as a monopolist, raise price by a small but significant non-transitory amount (often taken to be five to ten percent). If the collection of firms could do so, then presumably the firms "outside of the market" do not substantially constrain the firms "inside the market". Although primarily developed as a screening device for clearing inconsequential mergers,

120 economists and lawyers sometimes advocate using this approach to market definition in conduct cases as well.

121

This approach, however, must be used with special care when multi-sided platforms are involved. The pricing analysis must consider all sides of the market and their interactions. This is apparent from looking at the equilibrium conditions for determining pricing levels and pricing structures in multi-sided platform markets (see, for example, Equations 2, 4 and 5 above). The Justice Department's approach in

United States v. Visa U.S.A.122 illustrates the problem. MasterCard and Visa service cardholders and merchants. The DOJ's economic expert asked whether a hypothetical merger of all credit and charge card issuers could profitably raise prices to cardholders, looking only at profits on the issuer/cardholder side.

123 This analysis failed to consider two factors. First, any decrease in cardholder volume would lead to a decrease in merchant volume. Second, if merchant volume decreases, then any profits on the merchant side would also decrease, leading to a decrease in merchant demand for the system (which could then lead to a decrease in cardholder demand, and so on). The DOJ's economist did not consider effects on profits on the merchant side. Changes in cardholder volume would affect profits on both the issuing and acquiring sides. By focusing only on the cardholder side, the analysis put forward by the government's economist neglected at least half of the story. The importance of the interaction between the two sides is, of course, an empirical question.

124

This kind of mistake is easy to make. One tends to think of the services being supplied to merchants as different than the services supplied to cardholders and therefore categorize the services as being in different markets. It is natural, although wrong, to ignore the coupling. The error of treating multi-sided markets in isolation from one another is even easier when the other market is one in which the "product" is priced at zero or is given away, because in that case one does not think of firms as competing for sales. Thus, it is easy to think of shopping malls as renting space to retailers (ignoring the market for shoppers), Adobe as selling document production software (ignoring the market for readers), Palm as selling software and hardware systems for personal data management (ignoring the market for applications), and television stations as selling advertising (ignoring the market for providing content to viewers). In all these cases, the pricing and production decisions are inextricably intertwined.

There may be cases where the crossover effects are small enough that a single side constitutes a market under the merger guidelines test described above. That, however, demonstrates a weakness in the merger guidelines approach, since an understanding of multi-sided markets is necessary to identify anti-competitive conduct even if the crossover effects are small. Suppose a correct application of the merger guidelines approach finds that a single side of a multi-sided market is a relevant antitrust market. In practice, that will tend to lead the court to view market power and anti-competitive conduct within the four corners of that market. The court will tend to get the economics wrong, since the principles that explain pricing and other business behavior in a multi-sided market are fundamentally different than in a single-sided market.

- Market Power

Market share as a proxy for market power is problematic in many circumstances but is especially so for businesses that compete in multi-sided platform markets.

125 Economists have shown that Cournot-competition or differentiated-market Bertrand competition among firms in single-sided markets implies that the equilibrium prices will depend on some function of market shares.

126 Those models do not apply when looking at just one side of multi-sided platform businesses. Pricing power on each side depends on the degree of competition on both sides. For example, in Rochet and Tirole's model, multihoming on one side of the market "intensifies price competition" on the other side of the market.

127 Consider also the video game industry. The pricing power of a video game console maker depends on its share of game developer efforts as well as its share of console sales.

More sophisticated analyses do not rely on market share as a proxy but instead seek to determine directly whether the firm under consideration prices above marginal cost by a significant amount. As seen earlier, however, there is no necessary relationship between price and marginal cost on any side of multi-sided platform markets, hi fact, the price on one side of the market could be well above marginal cost, while the price on the other side of the market could be below marginal cost. To analyze market power from this perspective, one has to examine whether the total price is significantly above total marginal costs.

In markets in which there are significant fixed costs--the case in most, if not all, platform markets--one needs to be careful about inferring too much competitive significance even from the fact that firms' prices exceed marginal costs. If the purpose of the market power inquiry is to assess the state of competition in the industry, it makes more economic sense, in theory, to look at the risk-adjusted rate of return on investment.

128 For multi-sided platform markets, that analysis should consider the total returns and the total investment in all sides.

129 For example, eBay has made significant investments in developing buyer communities even though it realizes most of its revenues from sellers.

130 It likely charges sellers more than the marginal cost of serving them.

131 Alternatively, one could assess the degree of market power by determining the extent to which incumbents are constrained in their pricing and innovation behavior by the prospect of entry. That involves assessing the extent to which there are barriers to entry by equal or more efficient rivals--a topic I consider separately below.

132 Even markets that appear to be dominated by a single player may be contestable. Jullien's model "suggests that it may be easier than expected for a superior technology to enter, provided that the quality improvement is large enough."

133 Because many of the multi-sided markets are fast moving, current leaders often face competition in the form of potential entrants--other platforms striving to displace today's leader. Caillaud and Jullien argue that the Internet represents one such environment:

Too many ways of stealing the competitors' business appear. Unsurprisingly, the strategic situation is very unstable and the only equilibrium situation that is tenable is for a firm to exert dominance on the intermediation market, i.e., to be the sole supplier of intermediation services, without enjoying any market power as potential entrants create a strong disciplinary device for the dominant firm. In some sense, this market is extremely contestable.134

In merger inquiries, market power is the central inquiry: Would the merging parties have the power to increase price significantly? For mergers that involve platforms, it is not possible to answer that question without considering the combined and interrelated effects on all customer groups served by the platform. The merger of two platforms will affect their price levels and price structures. Depending on their cost and demand structures and the state of competition, the equilibrium post-merger prices could result in prices changing disproportionately and could conceivably result in one price falling.

135 There is an additional point the merger inquiry would need to consider. Mergers that increase the customer base on one side increase the value on the other side(s). Therefore, consumer welfare may increase even though prices increase on one side or in total.

136

Consider the following hypothetical merger. There are two chains of dating clubs in Boston--AAA Mates and Best Match (clubs

A and

B, respectively). They cater to somewhat different clienteles. Club

A charges men $20 for admission and women $0; Club

B charges men $30 for admission and gives women a $5 credit (in the form of free drinks). Club

B has been more successful because it attracts more women and as a result of that it attracts more men. In fact, it is so successful that--like an "in" discotheque--it typically has a line and can select the men and women to admit. It tries to weed out "undesirable" men and women. Assume that dating clubs in Boston is the relevant market. Club

A has a twenty percent share of admissions and

B a forty percent share. Will the merger raise prices? One cannot answer that question by looking just at the demand for patrons overall--e.g., by estimating the demand for admission against the average price. The mix of men and women is critically important. One would have to estimate the demand for men and the demand for women simultaneously. Then, using the theory of pricing in two-sided markets considered earlier together with information on cost, one could predict whether the merger would lead the combined firms to increase their total price.

137

Let us suppose that the analysis shows that the merged club would charge $32 for men and give women a credit of $6 at both locations. Assuming equal numbers of men and women, the average price charged at Club Awould rise from $10 to $13, and the average price charged at Club B would rise from $12.50 to $13. It is unclear whether dating customers are better or worse off. On average the customers pay more. But in the aggregate they could get more as well: The men may have a better selection of women to choose from and the women may have a better selection of men to choose from.

- Barriers to Entry

Barriers to entry merit separate treatment because they are important to the analysis of both market definition and market power. In market definition, barriers to entry are relevant for assessing whether firms can come into the market and thereby constrain price increases of incumbent firms. In measuring market power, barriers to entry may determine whether the firm in question

138 can exclude competitors and thereby maintain prices that exceed some competitive norm. This is of particular concern in monopoly maintenance cases where a preliminary issue is whether the defendant has monopoly power. According to du Pont, a firm has monopoly power if it has the power to "control prices or exclude competition."

139 The definition of barriers to entry is a controversial topic, much debated among antitrust scholars. Some take the position that anything that makes it "hard" to get into a market should be considered a barrier,

140 while others prefer to restrict use of the term to advantages that an incumbent firm has that an entrant cannot secure.

141

Multi-sided platform markets are usually "hard" to get into in the sense sometimes used in antitrust analyses: Getting into these markets is hard just as climbing stairs is hard, but entering is not hard in the same sense as gaining membership to the Augusta National Golf Club is hard.

142 Entrants may require large sums of capital.

143 That appears less true during the fairly lengthy childhoods of some platform industries; Marco Iansiti and I have found that many successful platforms start out small and expand over time.

144 Multi-sided platform markets are also hard to get into because firms must solve quite complex business problems. That complexity may, however, give subsequent entrants an advantage; they can look to the pricing structures and business models adopted by successful incumbents. When American Express entered the charge card business in 1958, for example, it could observe the success of the pricing structure that Diners Club had adopted when it entered in 1950. When Palm entered the operating system business for handheld devices, it could observe the success of Microsoft's business model of both developing applications internally as well as assisting independent developers to write applications. Lastly, building up critical mass on multiple market sides is hard. Of course, as in any market in which there are substantial scale economies in demand or supply, there is no guarantee that entry is sufficient to prevent incumbent firms from realizing risk-adjusted returns that exceed the competitive level.