Kim-Mai Cuttler -

TechCrunch

Silicon Valley is a place that is just as much about people reinventing themselves as it is about people reinventing industries.

As a new year turns, it’s time to go through that silly (but actually necessary) exercise of pausing to reflect. In a world of endless e-mail and distractions, it’s hard to remember where we came from, or where we are collectively going. For better and worse, Silicon Valley suffers from a perpetual loss of memory.

I have three simple stories about reinvention, that hopefully present a historical arc of this place. They belong to my family. For three generations, we have come here — before the orchards were cut down for silicon chip factories, before the chip makers left for Asia, before the dot-com era transformed warehouses into startup offices and before drones and Bitcoin.

1930s-1960s: Hard Sciences

Even though the “Silicon Valley” moniker only came into existence in the 1970s, this place’s history as a technology hub is about a century old. The establishment of Stanford and the University of California system along with generous federal research funding formed an initial pool of talent in the 1930s through 50s.

After escaping Russian pogroms as persecuted Jews during the turn of the 20th century, my great-grandparents managed to make it to Ellis Island. To make ends meet during the Great Depression, they ran a grocery and Jewish deli in Los Angeles. My grandfather used to tell me stories of 5-cent hamburgers and being cast as a

Liszt-piano playing extra in the Frank Sinatra film “Anchors Aweigh” when he was a teenager.

They never had much, so my grandfather ran out of money after four quarters of college and had to drop out of Stanford. He left to join a small electronics company back in Los Angeles to work on frequency meters and to help the family out with money.

It took him about nine years to come back and finish. It was a setback, but along the way he met my grandmother. He didn’t get his bachelor’s degree until he was 30 — an age that some people might be written off in this forever youth-obsessed industry.

But he went onto become one of a few elite physicists that designed the world’s most accurate timepieces. In the 1970s, his atomic clocks were flown around the world to

prove parts of Einstein’s general theory of relativity — the idea that time does slow down when you move closer to a strong source of gravity.

In 1966, when Dave Packard enlisted my grandfather to be part of the founding team for HP Labs, Packard

said something to the effect of, “We have drunk from the Well of Knowledge for many years. It’s now time to return something to that well.” While it’s easy to look at photo-sharing apps or social, mobile, local concepts and say that Silicon Valley is just pushing around eyeballs for ad dollars, this ambition lingers. It’s the same kind of thinking that fuels Google X’s moonshots and SpaceX rockets past the earth’s stratosphere.

In classic Valley fashion, my grandfather never really accumulated too many possessions beyond some antique clocks because of his fascination with ultra-precise time-keeping. Ever the engineer, he would do quality assurance on Thanksgiving dinners by testing a prototype turkey ahead of time. Then after a

BART crash in Fremont in the 1970s, he was asked to design a better system that would prevent train blockages. So in a way, he contributed to both the immaterial and very physical fabric that binds Silicon Valley together.

The point of bringing his story up is that we are standing on the shoulders of giants. The consumer Internet era owes itself to the proliferation of PCs in the 1980s and 1990s, which then owe themselves back to basic research efforts and funding that formed the foundation of Silicon Valley back in the 1930s and 40s.

Around the time of my grandfather’s death, his clocks were providing as much as 80 percent of the data used to support International Atomic Time. IAT is the basis of Coordinated Universal Time or UTC, the standard upon which Internet communications are synchronized. Back in the 1990s, even

Netscape kept a couple of atomic clocks in their offices. Great technical contributions can happen later in life, even though it often seems like VCs are always hunting for the next naively determined Harvard or Stanford dropout.

Even until my grandfather died of a heart attack while hiking in Big Basin at the age of 78, he was working. He never retired because he loved what he did.

1965-1995: The PC era and a new wave of immigrants

Silicon Valley was mostly orchards in the 1950s.

In 1965, a law was signed that would change the face of Silicon Valley forever.

The Immigration and Nationality Act of 1965 reversed decades of discriminatory quotas against immigrants from Asia, Latin America, Africa and the Middle East.

Because of war, political instability, repression or weak economic growth, Silicon Valley became a magnet for technically-skilled immigrants from East Asia, India and the former Soviet Union. This place prospered because corrupt and authoritarian regimes cost these countries their best resource — their people. At that time, India and China’s governments were barely two decades old and had yet to make the economic reforms necessary to create the kind of sustained growth that now makes them attractive markets to start companies in.

So given the choice, the U.S. was often a no brainer at that time. My mother was part of this wave, although she came as a war refugee instead of a technically-skilled migrant favored by the 1965 law.

She and her seven siblings (two of whom died in childhood) grew up in the bustle of 1960s Saigon. They grew up with pigs and chickens and episodes of the original Star Trek with Kirk and Spock, even as firefights and bombs often erupted on the outskirts of the city.

By 1974, it became clear that the American-backed government in South Vietnam was not going to last, so my mother left for Australia on her own at 18 and enrolled in the University of New South Wales. The hardest part of being there was not about being one of the very few women studying computer science in the 1970s (though imagine that!) The hardest part was that she lost contact with her family. For several months, she was alone. As Viet Cong forces rolled into Saigon, she had no idea if her sisters and parents were alive. Many of the other students in her program became depressed or suicidal.

Fortunately, my immediate family was lucky enough to make it out one day in 1975. They carried as much gold as they could in the linings of their clothing and discreetly snuck down bullethole-ridden streets. They sought out one of the last remaining aircraft carriers docked in the city. There was little time. While being ferried to the carrier, my aunts saw other refugees fall off the packed boats and drown. Still other high school classmates of my mother’s left on smaller boats only to be attacked by Thai pirates, who robbed and raped those on-board.

Even after crossing part of the Pacific to a Guam refugee camp, it still hadn’t hit them that they were never going back. It’s been almost 40 years now.

When my mother finished up in Australia and decided to reunite with the rest of the family in the U.S., they looked for a place to put down roots.

One morning in 1979, my mom opened the Sydney Morning Herald and there was this article in the business section about a place called “Silicon Valley.” It described a place full of industrial parks, burgeoning companies and most importantly, opportunity.

On a visit the following year, she and my grandfather, who barely spoke a word of English, bought Greyhound tickets all the way to California from Michigan. When she got here, she went up and down the peninsula, visiting Advanced Micro Devices and Stanford.

Somehow she knew in her bones that this was the place. My mom and her family crammed themselves into a one-bedroom apartment in Alameda until they could scrape together enough money to move closer to the heart of the Valley.

Even then, they couldn’t afford a car, so my aunts took the county bus system around the peninsula. They used the public buses like tourists, soaking in everything about their new country. One afternoon while riding a bus, my aunt saw that she was coming up on Hewlett-Packard’s corporate headquarters in Palo Alto. She stopped the bus, marched straight to the reception desk and asked if there was an HR person around. Then she demanded an interview on the spot. A week later she had a job.

Between the six sisters, they eventually saved up enough money to buy a house in San Jose, when real estate prices were still reasonable in the 1980s. Eventually, when they each started families, they moved into the same Cupertino neighborhood. This wasn’t a fact that I fully understood or appreciated until I lived in Vietnam in my early 20s — that many extended Vietnamese families all live in the same village.

Even though they lost their homeland, my mom and her sisters recreated their own village on the other side of the world.

With great loss came the chance for reinvention.

But it transformed into suburbs and industrial parks over the next generation.

1990s-onward: Web 1.0 and 2.0

I am not a child of the Great Depression nor am I a war refugee. I’m incredibly humbled by what my parents and grandparents have been able to do.

When I was younger, I took this place for granted. My dad spent his weekends with soldering irons and my high school friends literally lugged their desktop computers around the neighborhood to have LAN parties.

As a child, something seemed dead to me about the tech industry in the 1980s and early 1990s. Before the first Internet bubble, the Valley’s leading companies had tens of thousands of employees. It was more Dilbert and Office Space than phone phreaks and hackers. Take Your Children To Work Day meant seeing a sea of bland cubicles submerged beneath seven to ten layers of corporate management. You couldn’t be two people and impact 10 million users then. Across the city where I grew up, Apple was shuttering its old offices left and right because it was the early 1990s. Microsoft was winning.

Around that time, there was the

ugly proxy battle over the fate of Hewlett-Packard, one of the foundational companies of Silicon Valley and the one to which my family gave more than 100 years of collective service. The Hewlett family lost, the HP-Compaq merger went through, and the soul of a once great company died. While it’s easy to make fun of older companies in Silicon Valley, it’s hard to remember that they were once hungry and foolish too. Still, even though HP was lost, many other great companies like Google and Apple prospered in its place. Silicon Valley moved on.

I did too. Being a simultaneously naive and jaded teenager, I didn’t pursue what should have been a more technically inclined path and instead decided to be a journalist.

After university, editing my college newspaper and a string of decent internships, I left the Bay Area to go and live on three other continents. I went and lived in Vietnam, where I met my grandmother’s estranged sister. They last saw each other in 1954, when my grandmother decided to side with the U.S.-backed Southern Vietnamese government while her sister became a loyal Communist in the North. They exchanged some 50 years of letters filled with everything from mundane life updates to arguments about the relative merits of Communism and capitalism, which sometimes angered my grandmother to no end.

Then I ended up working in financial journalism in London, thinking that a foreign posting was a great escape from the bland industrial parks, highways and strip malls of California. But during the time I was away, my grandfather and maternal grandmother, who survived several decades of war and played a huge role in raising me, passed away. I missed them.

Working with bankers and traders also wasn’t the same as dealing with founders, engineers and hackers day in and day out. People were sharp, but they didn’t love their work — not the way my grandfather or dad did. Jobs in banking were a means to accumulate year-end bonuses and holidays. They didn’t spend their spare time messing with a half-dozen oscilloscopes or building makeshift telescopes.

There is a line in T.S. Eliot’s “Four Quartets”

that says, “The end of all our exploring shall be to arrive where we started and know the place as if for the first time.” So after the 2008 financial crash and several years away, I came home and became a tech journalist.

Ceaseless Changing

Some things are different from a generation or two ago. The more power and wealth the technology industry generates and the more it becomes embedded in everyday life, the more it attracts people who desire the trappings of wealth and power over the act of building and creating itself.

Through glamorizing acquisitions and playing up industry personalities, TechCrunch has played no small part in this. It’s a double-edged sword: by celebrating entrepreneurship, more people are emboldened to try it than ever before. On the whole, it’s probably a good thing for many more experiments to happen and for more people to take agency in their own lives. But it also means that we will have more prospective founders doing it for the ends, rather than the means or the journey.

The first contract Hewlett-Packard ever closed as a startup was one to build audio oscillators for the Disney movie Fantasia. Their products were several layers removed from the end consumer experience, so you really had to be a geek if you were going to work here. There was not much glamour or fame to be had. No Fortune or Forbes covers. No eight- or nine-figure exits. No hordes of Twitter or Instagram followers.

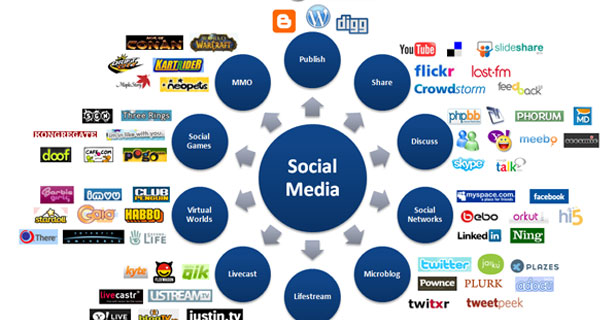

Today, technology companies like Facebook are replacing TV and movies. They are our new cultural mediums.

So in the same way that the medium influences the message, the medium also influences the kinds of people who choose to work in this industry. That’s why the Valley sometimes feels increasingly like the entertainment industry, with users shuttling from app to app like the hot restaurant or club opening of the week.

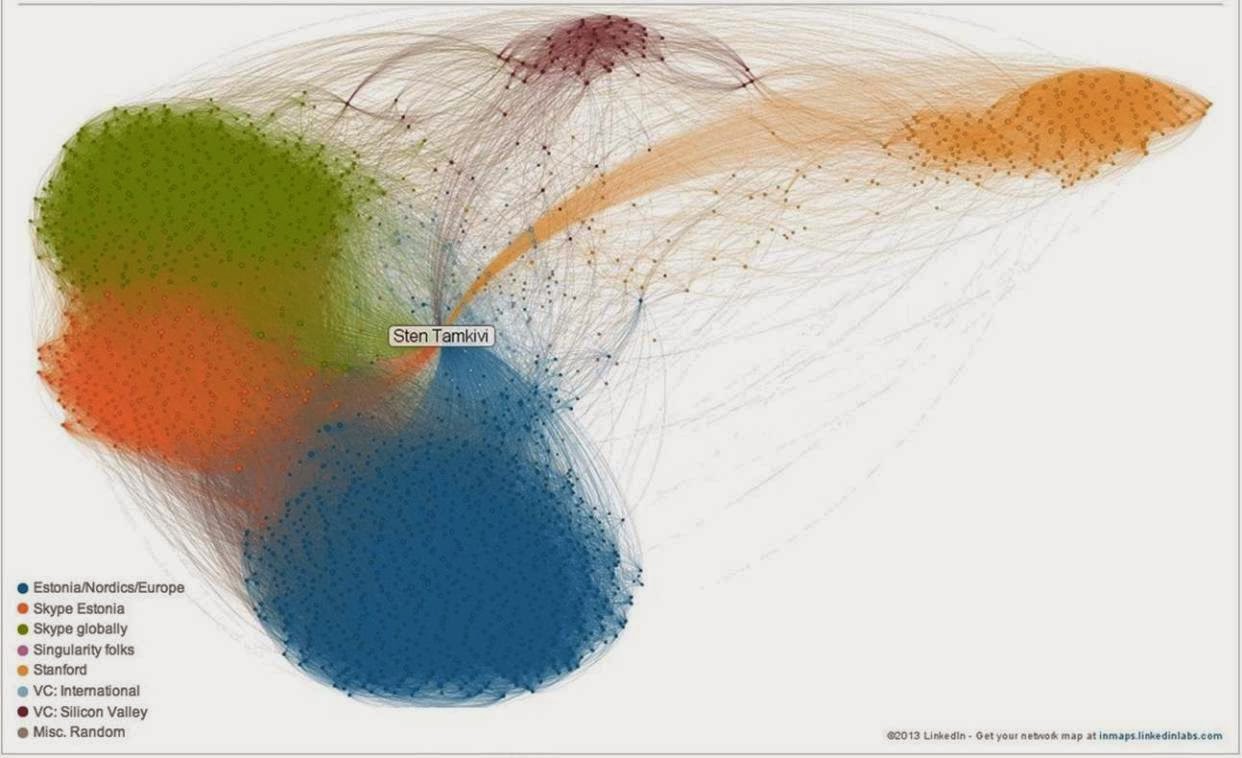

Secondly, the Valley is now a global mindset, not a single geographic destination. While it is still hard to find an ecosystem in the world that is nearly as supportive or as dense as Silicon Valley, the gap between here and communities elsewhere is narrowing.

The no-brainer decision that my mother made to come to the U.S. a generation ago is not so clear anymore. Beijing is an equally fascinating and active hub to start a company in. Many of the startups I meet now are distributed from the beginning, with offices here and in Bangalore, Slovenia, Pakistan, Finland and elsewhere. Silicon Valley is one very strong node among many.

Thirdly, I live in San Francisco and not the Peninsula, mirroring the Valley’s general move north into the city and this generation’s desire to live in urban cities over suburban areas. This urban shift has created painful consequences for San Francisco, while creating opportunities for diversification in other tech hubs like New York and Berlin. If software is eating the world, then the technology industry is eating more of the Bay Area.

This last year has been the most difficult and we need to find a more constructive way for San Francisco to accommodate people that want to be here and for the city to retain its quirkiness and diversity. With my own rent more than doubling over the last few years, I probably won’t be able to stay here long-term, either. Unless the city boosts the housing stock dramatically, San Francisco will increasingly become a city solely for the very young and the very rich.

However, in other ways, what drew my mother and my grandfather here is very much alive. A desire for non-conformity and a grandness of aspiration still exists in certain entrepreneurs here. The 150-year-old Gold Rush mentality lingers on in the engineers who show up every year from all over the world to try their luck at starting new companies. The Valley’s unique cultural language around materialism and status persists. While it does get flashier every year, there is still a certain discretion about being well-dressed or having a nice car here, at least compared to New York or Los Angeles.

That’s because this place is still such a lottery. Beneath the hard work is a hell of a lot of luck. Some years, you are up. Other years, you are down. One month, you are running the Valley’s most celebrated company. And the next, you are everyone’s favorite punching bag. Sometimes you raise a motherlode of a Series B, and a year later the entire landscape has changed around you and you’re screwed.

Everyone engaged in the act of changing the world is self-delusional on some level. Some small percentage of the time, the delusional succeed. That is part of the hits-driven nature of the venture business. This is the entrepreneur-as-hero myth that has become necessary to perpetuate the ecosystem here.

Few companies end up being wildly successful. Some fail outright. But most end up in some stomach-churning netherworld in-between. Invariably, all these startups are having problems hiring good engineers. The pool of job candidates is so tight many founders I know are having to scour universities around the rest of the country or hire abroad.

So like my mother and grandfather, who showed up here in their twenties, the young arrive all over again, even though they can barely afford the security deposits on apartments.

Once and young, they come, hungry to walk that tenuous line between self-awareness and self-delusion necessary for the act of creation.

As they reinvent themselves, they reinvent this place just the way my parents and grandparents did. We are lost and then found once more.

0:30

0:30

Juan MC Larrosa

Juan MC Larrosa

.png)

.png)